DBS announced the launch of DBS Wealth Chat, a service that will allow DBS’ wealth clients to interact, exchange ideas and transact with their relationship managers via popular instant messaging platforms WhatsApp and WeChat.

The bank claims to be the first in Southeast Asia to enable this service for its clients. Developed in partnership with regulatory technology (regtech) start-up FinChat, it enables DBS’ clients to use their existing instant messaging platforms to access DBS’ wealth services while meeting rigorous compliance standards.

The Process

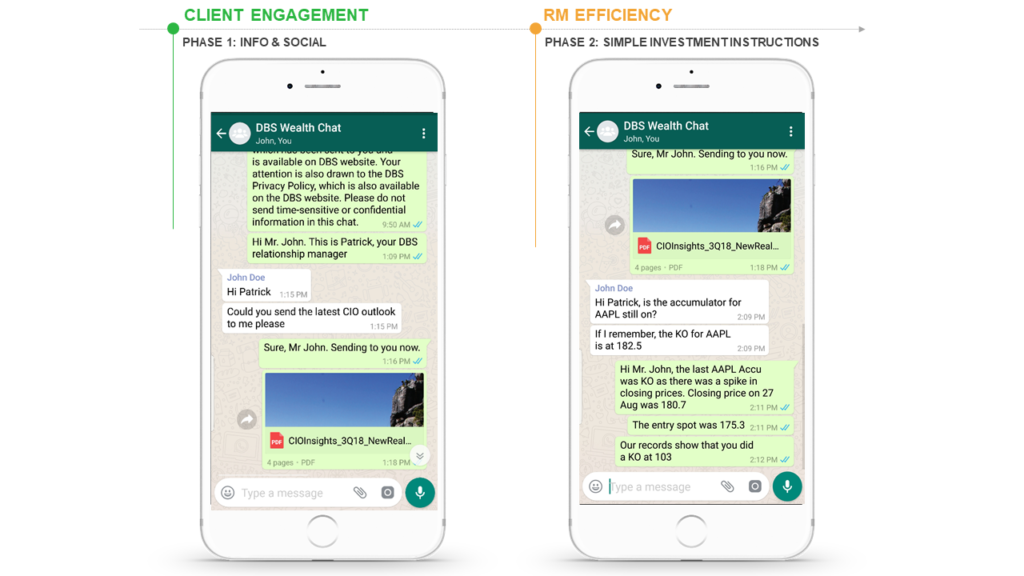

To access the service, relationship managers can register interested clients in a private chat group with the bank. Upon confirmation, DBS will set up a unique chat group administered by the bank between the client and his/her relationship manager

Once the chat group between the relationship manager and client is initiated, conversations and file exchanges that occur within the chat group will be archived by the bank without any intervention required from the relationship manager. The entire process is fully automated.

Why is DBS Enabling Their Banking Services via Popular Messaging Apps

At present, relationship managers need to ensure key client conversations take place via the bank’s phone lines, where they can be recorded. DBS Wealth Chat allows RMs to communicate with clients on the go, on their clients’ preferred instant messaging platform. This, in turn, allows for speedier service delivery to clients.

The introduction of DBS Wealth Chat is estimated to save some 10,000 manhours on a yearly basis, while enhancing the ease and quality of relationship manager and client interaction.

“We recognise that customers today are inundated with different apps and services and decided to go where our customers already are – WhatsApp has upwards of 1.5 billion users, while WeChat has close to one billion users. Our aim is to provide banking services that are embedded in our customers’ everyday lives, while maintaining client privacy and keeping to our rigorous security requirements,”

said Tan Su Shan, Group Head of Consumer Banking & Wealth Management of DBS.

In the first phase, DBS will begin to register and onboard interested wealth clients in Singapore on the service, where content such as DBS Chief Investment Office reports, research insights and ideas, and exclusive invitations will be shared. Additional investment-related transactions (such as trade placement) will be introduced progressively in 2019.